AML/CTF compliance

doesn’t have to be overwhelming.

AML/CTF compliance

doesn’t have to be overwhelming.

AML/CTF compliance

doesn’t have to be overwhelming.

We’re your trusted AML/CTF partner.

Tailored AML/CTF Program.

Tailored AML/CTF Program.

AML/CTF Compliance Officer Certification.

AML/CTF Compliance Officer Certification.

On-demand AML/CTF training.

On-demand AML/CTF training.

Real time, reliable AI powered answers to your questions.

Real time, reliable AI powered answers to your questions.

Trusted by leading businesses

Trusted by leading businesses

Sound Familiar?

You’re not alone.

I've been to conferences and webinars, but I still don't understand what I need to do.

I'm not sure if the template that I've been given meets our regulatory obligations?

I spend all day answering AML/CTF questions.

We don't have enough resource to develop and implement an AML/CTF framework.

I don't know if we're doing it right.

Products & Services

All your AML/CTF needs. Expertly handled.

All your AML/CTF needs. Expertly handled.

We combine practical experience and digital solutions to help businesses understand and satisfy their AML/CTF compliance obligations.

On-demand AML/CTF Training

Satisfy your regulatory obligations, reduce risk and streamline operations with engaging, role specific online AML/CTF courses. It's every thing that you need to know in one place.

On-demand AML/CTF Training

Satisfy your regulatory obligations, reduce risk and streamline operations with engaging, role specific online AML/CTF courses. It's every thing that you need to know in one place.

On-demand AML/CTF Training

Satisfy your regulatory obligations, reduce risk and streamline operations with engaging, role specific online AML/CTF courses. It's every thing that you need to know in one place.

Week 1

Week 2

Week 3

AML/CTF Compliance Officer Certifications

Get recognised for your expertise with our AML/CTF Compliance Officer Certification, developed by experts specifically for Australia.

Week 1

Week 2

Week 3

AML/CTF Compliance Officer Certifications

Get recognised for your expertise with our AML/CTF Compliance Officer Certification, developed by experts specifically for Australia.

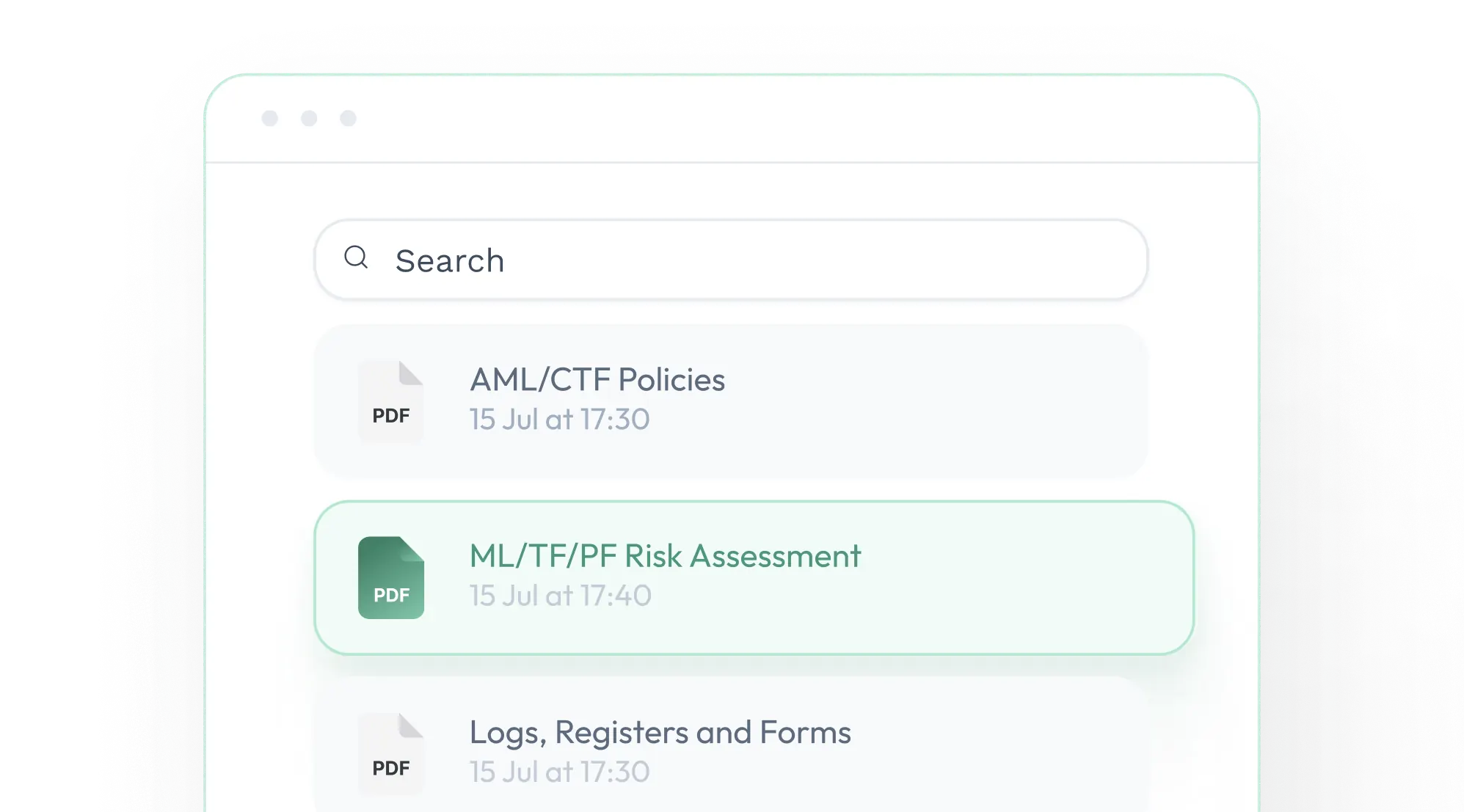

Q&Aᴬᴵ Assistant

Searching for answers takes time and it's hard to know if you're right. Get real-time, reliable answers to AML/CTF questions based on law, guidance and your internal policies and documents.

Q&Aᴬᴵ Assistant

Searching for answers takes time and it's hard to know if you're right. Get real-time, reliable answers to AML/CTF questions based on law, guidance and your internal policies and documents.

AML/CTF Consultancy

Templates create regulatory risk. We work with you to develop an AML/CTF Program that's tailored to your business. We also support you to implement and maintain your AML/CTF Program.

AML/CTF Consultancy

Templates create regulatory risk. We work with you to develop an AML/CTF Program that's tailored to your business. We also support you to implement and maintain your AML/CTF Program.

AML/CTF Consultancy

Templates create regulatory risk. We work with you to develop an AML/CTF Program that's tailored to your business. We also support you to implement and maintain your AML/CTF Program.

AML/CTF compliance

doesn’t have to be overwhelming.

doesn’t have to be overwhelming.

Reviews

What Customers Say

What Customers Say

Managing Director

Property Credit

We’ve had an excellent experience Upskill. As consultants they are knowledgeable, supportive, and thorough from day one. The UpSkill courses have also been a game-changer: educational, relevant, and already driving meaningful improvements to our internal policies and procedures.

Compliance Manager

Fund Manager

UpSkill has set the bar high with their professional and polished offering.

General Counsel

Credit Fund

UpSkill delivers the most amazing products and services, and their professionalism is infectious. We love working with them.

Director of Investor Relations & Operations

Fund Manager

We strongly recommend UpSkill to any reporting entity.

Managing Director

Property Credit

We’ve had an excellent experience Upskill. As consultants they are knowledgeable, supportive, and thorough from day one. The Upskill courses have also been a game-changer: educational, relevant, and already driving meaningful improvements to our internal policies and procedures.

Compliance Manager

Fund Manager

UpSkill has set the bar high with their professional and polished offering.

General Counsel

Credit Fund

UpSkill delivers the most amazing products and services, and their professionalism is infectious. We love working with them

Director of Investor Relations & Operations

Fund Manager

We strongly recommend UpSkill to any reporting entity.